Texas is a prime spot for residential..

Read More

Single Family Office Guide to Texas Real Estate Investments

Texas is a prime spot for residential real estate investments, perfect for both new and seasoned family offices. The state boasts a booming economy and a rapidly growing population. Many major corporations are relocating to Texas, further fueling economic growth and creating numerous job opportunities. This influx of jobs draws more people, which increases demand for housing. Texas also has a favorable tax environment. There is no state income tax, which is attractive for investors looking to maximize their returns. The affordability of real estate compared to other major markets makes Texas an ideal place for long-term investments. Properties here provide great cash flow opportunities and have a strong potential for appreciation. These factors make Texas a suitable choice for diversifying investment portfolios and achieving financial growth. Whether you aim to start your investment journey or look to expand an existing portfolio, Texas offers diverse options to meet your needs. Family offices can find valuable opportunities in single-family homes, multifamily units, and rental properties. Understanding the fundamentals of the Texas market is key to making informed investment decisions and maximizing returns. Understanding Texas Residential Market Fundamentals Key Residential Market Trends in Major Cities Texas’s major cities like Austin, Dallas, and Houston are experiencing significant growth. Austin has become a tech hub, attracting companies like Apple and Tesla. Dallas boasts a diverse economy, while Houston remains strong in energy and healthcare sectors. These cities see a steady influx of new residents, pushing up housing demand and prices. High-Demand Property Types In Texas, single-family homes and multifamily units are highly sought after. Single-family homes are favored by families and long-term residents. Multifamily units, including duplexes and apartment buildings, cater to younger renters and those seeking flexibility. Both property types offer solid investment potential with steady rents and high occupancy rates. Investor-Friendly Factors Texas is an investor-friendly state. The absence of state income tax is a significant draw for investors. Additionally, housing prices in Texas are more affordable compared to other large markets. High rental demand, driven by a growing workforce and population, ensures good rental income. These factors make Texas an attractive place for expanding real estate portfolios. Getting Started: Investment Strategies for Family Offices Direct Residential Acquisitions Family offices can start by purchasing single-family or multifamily rental properties. Look for areas with stable growth potential. Cities like Austin, Dallas, and Houston are great options due to their strong economies and growing populations. Focus on neighborhoods with good schools, low crime rates, and proximity to jobs and amenities. Leveraging Private and Institutional Lending Utilize private and institutional funding sources to expand purchasing power and maintain liquidity. Family offices can benefit from lower interest rates and flexible loan terms. Leveraging these funds helps manage risk and enables the acquisition of multiple properties, enhancing portfolio growth. Partnering with Local Experts Local expertise is invaluable. Partner with experienced Texas-based real estate agents, property managers, and legal advisors. They understand local regulations, market dynamics, and can provide insights into the best investment opportunities. Local partners can also help manage properties efficiently, ensuring steady income and lower vacancies. Portfolio Growth Strategies for Existing Investors Portfolio Diversification Diversifying within Texas can help balance risk and increase potential returns. Consider investing in a mix of single-family homes, multifamily units, and rental properties across different cities. For example, blend properties in fast-growing suburbs with those in established urban neighborhoods. This approach reduces exposure to market fluctuations and capitalizes on various growth trends statewide. Value-Add Opportunities Adding value to properties is a smart strategy for maximizing returns. Look for fixer-uppers or older properties that can be renovated. Upgraded amenities or modern layouts can significantly increase property value and rental income. Simple improvements like new kitchens, bathrooms, or energy-efficient systems can attract higher-paying tenants and boost occupancy rates. Scaling with Rental Property Management Outsourcing property management can streamline operations, especially for larger portfolios. Professional property managers handle tenant screening, maintenance, and rent collection efficiently. This allows family offices to focus on expanding their portfolio without getting bogged down in day-to-day tasks. Good property managers also ensure tenant satisfaction, leading to lower vacancy rates and steady cash flow. Valuable Tips for New and Accredited Investors Researching Local Markets Researching local markets ensures you invest in areas with the highest potential returns. Look into neighborhoods with good schools, low crime rates, and access to jobs. High-growth areas with new infrastructure projects often present great opportunities. Check local job growth indicators to find stable residential locations that promise long-term viability. Setting Realistic ROI Goals Set achievable Return on Investment (ROI) goals based on Texas market trends. Factor in property appreciation rates and expected rental incomes. Be conservative in your calculations to avoid overestimating potential returns. A clear, realistic goal helps in making informed decisions and tracking investment performance. Taking Advantage of Tax Benefits Take full advantage of the tax benefits available in Texas. Mortgage interest deductions and property depreciation can significantly reduce taxable income. Familiarize yourself with local and federal tax incentives to maximize your returns. Consider consulting with a tax advisor to ensure you leverage all available benefits effectively. Conclusion Investing in Texas residential real estate offers numerous opportunities for both new and experienced investors. The state’s strong economic growth, favorable tax environment, and diverse housing options make it a prime location for real estate investments. By understanding market trends, diversifying portfolios, and leveraging local expertise, family offices and individual investors can maximize their returns. Family offices starting out can benefit greatly from direct residential acquisitions and should consider using private and institutional lending to expand their purchasing power. For those managing larger portfolios, value-add opportunities and professional property management can drive significant growth. By conducting thorough market research, setting realistic ROI goals, and taking advantage of tax benefits, investors can optimize their investment strategies. Explore the potential of Texas real estate with Elysium Real Estate Investments LLC, a real estate advisor. For tailored guidance and deeper insights, contact us for a consultation. Let Elysium Real Estate Investments LLC help you make informed,

Asset Protection Fundamentals: Trusts for Real Estate in Texas Explained

Protecting your assets is crucial for real estate investors in Texas. Trusts offer valuable legal benefits, tax efficiencies, and liability protection. These advantages make trusts an excellent tool for people like investors, family offices, retirees, and entrepreneurs who want to preserve and grow their wealth. Trusts provide significant protection against potential liabilities. They can shield your assets from legal claims and lawsuits, giving you peace of mind. Additionally, trusts can help with effective tax planning. By utilizing trusts, you can take advantage of tax benefits that allow for more efficient tax management, ultimately saving money. Investing in a trust can be a smart move for safeguarding your investments and planning for the future. Understanding the different types of trusts and how they can be tailored to your needs is key to making the most out of your real estate investments in Texas. The Importance of Asset Protection for Texas Real Estate Investors Safeguarding Against Liabilities When you invest in real estate, protecting your assets from legal claims and liabilities is crucial. Trusts offer a strong layer of protection. If someone sues you, the assets held within a trust are usually not considered part of your personal estate. This means those assets are shielded from legal claims and judgments. For real estate investors, this can prevent significant financial losses and provide peace of mind. Tax Planning Efficient tax planning is another reason to consider using trusts. Trusts can help you take advantage of various tax benefits, reducing how much you owe each year. Certain trusts allow for asset growth without the burden of immediate taxes. By deferring taxes or even lowering tax rates, you can retain more of your earnings. This can be especially useful for high net worth individuals who aim to maximize their investment returns. Estate and Succession Planning Trusts simplify the process of passing on your assets to your heirs. By avoiding the lengthy and expensive probate process, you ensure your real estate investments are transferred smoothly. This is ideal for family offices and entrepreneurs who have multi-generational wealth. With clear instructions within a trust, you can manage how your assets are distributed, ensuring your family’s needs are met, and your estate’s value is preserved. Types of Trusts for Real Estate Asset Protection Revocable Living Trust A revocable living trust offers flexibility and control. You can add or remove assets as you wish and even alter the trust during your lifetime. This type of trust helps you avoid probate and maintain control over your assets, making it great for pre-retirees and entrepreneurs looking for flexibility in their estate planning. Irrevocable Trust An irrevocable trust provides a higher level of asset protection compared to a revocable trust. Once assets are transferred into an irrevocable trust, they are no longer part of your personal estate. This is ideal for accredited investors and high net worth individuals focused on shielding their assets from legal claims and estate taxes. Land Trust Land trusts are specific to real estate and offer the benefit of anonymity. They help keep your name off public records, adding a layer of privacy to your investments. This can be particularly appealing for expatriates and overseas investors who seek discretion in their property holdings. Qualified Personal Residence Trust (QPRT) A Qualified Personal Residence Trust (QPRT) is designed to help transfer a personal residence to heirs while minimizing estate taxes. You can continue to live in the home for a specified term, after which it transfers to the beneficiaries. This is a wise choice for high net worth individuals looking to pass on their residence without a hefty tax burden. Dynasty Trust A dynasty trust is perfect for family offices and those managing multi-generational wealth. It allows for the transfer of assets to beneficiaries while avoiding estate and gift taxes for several generations. This trust ensures long-term financial security and helps preserve family wealth over time. Five Key Questions Investors Should Ask What Is the Best Trust for My Investment Goals? Choosing the best trust depends on your specific goals. A revocable living trust offers flexibility, allowing you to manage your assets and make changes as needed. This is ideal for pre-retirees and recent retirees who might need access to their assets. For those concerned about maximum protection and tax benefits, an irrevocable trust might be better. It shields assets from creditors and can have significant tax advantages. How Soon Should I Establish Trust in My Assets? The timing of establishing trust is vital. If you’re accumulating assets quickly or planning major future investments, it’s wise to set up a trust early. This is particularly important for high net worth individuals looking for long-term protection. Estate planning milestones, such as retirement or the birth of a grandchild, are also key times to consider. Starting early ensures your assets are protected and your estate plans are in place. What Are the Potential Tax Benefits? Each trust type comes with unique tax benefits. For example, a Qualified Personal Residence Trust (QPRT) allows you to reduce estate taxes by transferring your home into the trust. Irrevocable trusts can remove assets from your taxable estate, lowering your estate tax bill. By understanding how each trust works, you can maximize tax advantages and improve your overall financial strategy. Does a Trust Protect Me from Personal Creditors? Most trusts offer some degree of protection from personal creditors. Irrevocable trusts are particularly strong in this regard, as assets within the trust are no longer considered part of your personal estate. This means they can’t be seized to satisfy personal debts. Revocable trusts, while useful for other reasons, offer less creditor protection, so understanding the level of protection each trust offers is key. What Are the Setup Costs and Process Steps? Setting up a trust involves initial costs and a series of steps. You’ll need to consult with a legal expert to draft the trust documents, which can cost a few thousand dollars depending on complexity. The setup process typically includes transferring your assets into the trust,

Retirement Planning with Texas Real Estate for Entrepreneurs

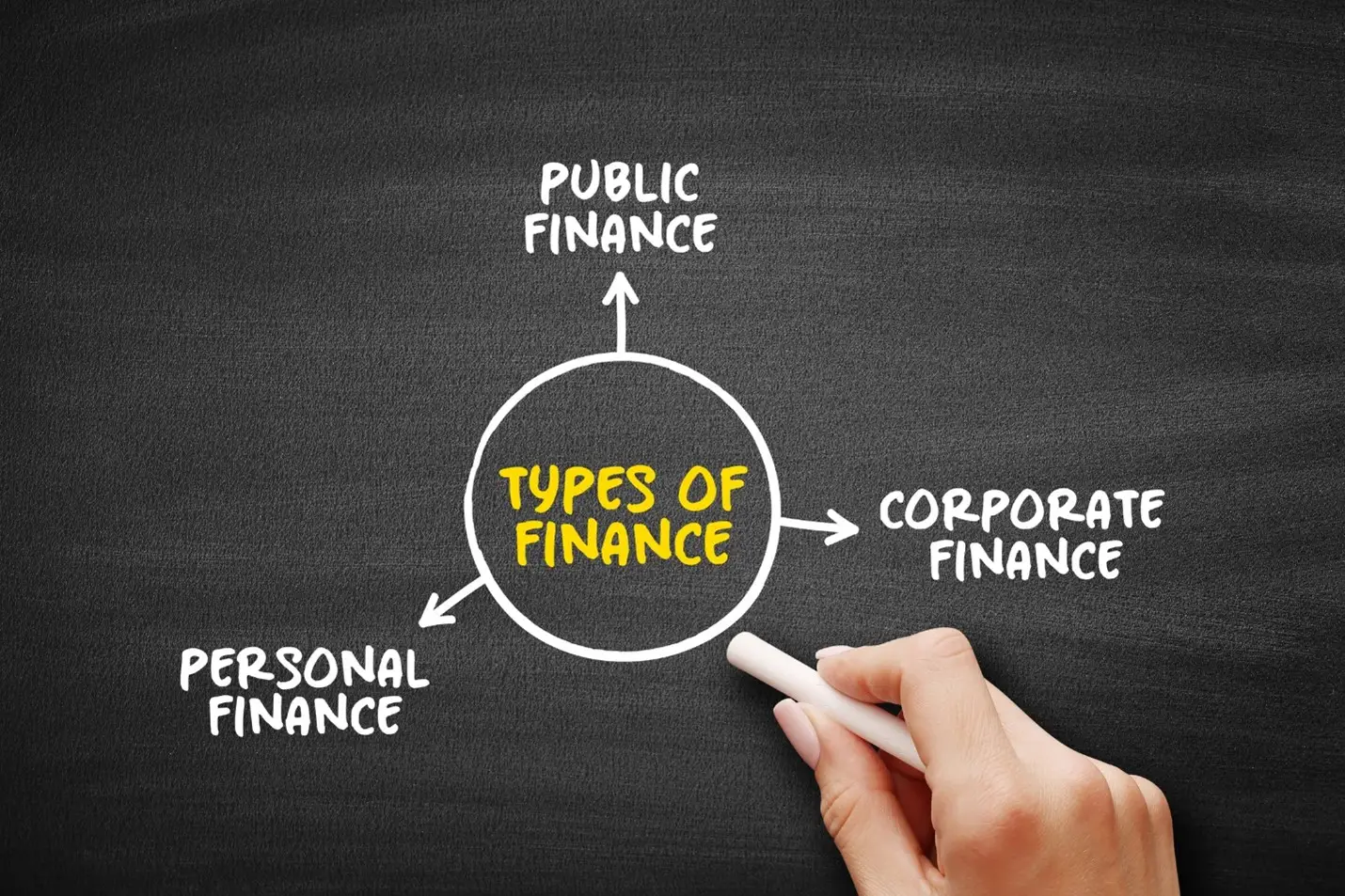

Texas real estate offers a unique opportunity for entrepreneurs and investors to build retirement wealth. The state boasts strong market fundamentals like robust economic growth, a steady influx of new residents, and relative affordability. These factors make Texas an attractive choice for those looking to secure their financial future. Investing in Texas property can provide stable rental income, which is key for predictable cash flow during retirement. Cities like Austin, Dallas, and Houston have seen consistent growth, driving up property values and rental demand. This consistent cash flow can be a reliable income source, helping retirees cover daily expenses without dipping into their savings. Tax advantages also play a significant role in retirement planning through real estate. Texas offers benefits like depreciation and mortgage interest deductions, which help reduce tax liability. These incentives can enhance overall returns, making it easier for entrepreneurs to build a solid retirement nest egg. Understanding Texas Real Estate as a Retirement Strategy Stable Cash Flow Investing in Texas residential real estate can provide a stable cash flow, essential for retirement planning. Rental properties generate a steady income from tenants, which can be a reliable financial support during retirement. High-demand areas in Texas like Austin, Dallas, and Houston have strong rental markets, ensuring you have consistent tenants and minimal vacancies. This predictable cash flow helps retirees manage monthly expenses without depending solely on savings or pensions. Asset Appreciation Texas has a history of property appreciation, making it a strategic choice for real estate investment. Cities like Austin and San Antonio have shown significant growth, both in property value and local economy. This appreciation means that the value of your real estate investment can increase over time, potentially providing you with substantial returns when you decide to sell. Emerging neighborhoods in these cities are particularly promising, offering great potential for appreciation as they develop. Tax Advantages One of the key benefits of investing in Texas real estate is the tax advantages. Property owners can take deductions for mortgage interest and depreciation, which reduce overall tax liability. These tax incentives help enhance the returns from real estate investments, making it a smarter choice for retirement planning. By leveraging these benefits, you can maximize your investment’s profitability and keep more of your earnings. Getting Started: Investment Strategies for New and Accredited Investors Choosing High-Growth Locations For new and accredited investors, selecting high-growth locations is crucial. Areas such as Austin, Dallas, and Houston are known for their economic vitality and population growth, making them ideal for residential real estate investments. Look for neighborhoods with good schools, low crime rates, and access to amenities which often have higher rental demand and appreciation potential. Funding Options Exploring different funding options is a key step for new investors. Private and hard money lenders provide flexible financing solutions, especially beneficial for entrepreneurs with varied risk tolerances. Whether you are using a conventional mortgage or alternative financing, it’s important to understand the terms and how they align with your investment goals. This way, you can secure the capital needed without overextending yourself financially. Hands-Free Investment Management Hands-free investment management is an attractive option for busy entrepreneurs. Professional property managers can handle everyday tasks like tenant screening, rent collection, and maintenance. This not only saves time but ensures that your properties are well-maintained and tenants are satisfied, leading to reduced vacancies and consistent cash flow. For someone seeking passive income, this approach makes real estate investment much more manageable and less stressful. Diversifying Locally: Expanding Beyond One’s City Evaluating Market Opportunities in Texas To diversify your real estate investments, consider expanding into new Texas cities. Austin, San Antonio, and Fort Worth are growing rapidly and offer numerous opportunities for real estate investors. Each city has its unique appeal and growth prospects. Evaluating these markets involves looking at local economic indicators, job growth, and housing demand. By understanding these factors, you can identify areas with strong potential for rental income and property appreciation. Expanding Property Types Diversification isn’t just about location; it’s also about property type. Adding different types of residential properties to your portfolio can reduce risk and increase opportunities for income. For example, mixing single-family homes with duplexes or multi-unit properties can create a more stable investment. Each property type offers different benefits. Single-family homes may appreciate faster, while multi-unit properties can provide higher rental yields. Collaborating with Local Experts Working with local experts can make all the difference when expanding into new markets. Real estate agents, property managers, and local investors can provide invaluable insights into market trends and regulations. They can help you identify promising properties and navigate local laws. Collaborating with these professionals ensures that you make informed investment decisions and maximize your returns. Tips and Insights for Retirement – Ready Investors Setting ROI and Cash Flow Goals Setting clear ROI and cash flow goals is crucial for retirement-ready investors. Determine what kind of return you need from your investments to meet your retirement needs. This could involve calculating expected rental income, property appreciation, and tax benefits. Having these goals helps guide your investment strategy and ensures that your real estate portfolio aligns with your financial objectives. Leveraging 1031 Exchanges for Portfolio Growth 1031 exchanges are a valuable tool for growing your real estate portfolio without incurring immediate capital gains taxes. These exchanges allow you to sell a property and reinvest the proceeds into a new property, deferring the tax liability. This strategy can help you scale your investments more rapidly and efficiently. Understanding the specifics of 1031 exchanges and working with a knowledgeable advisor can maximize this benefit. Utilizing Texas Tax Incentives Texas offers several tax incentives that can enhance your real estate investment returns. These include property tax deferrals for seniors, homestead exemptions, and deductions for mortgage interest and depreciation. Utilizing these tax advantages can significantly reduce your expenses and increase the profitability of your investments. Working with a tax professional familiar with Texas real estate can help you navigate these benefits and ensure you get the most out

Maximizing Returns with Texas Residential Properties

Texas’s residential real estate market is booming, making it a top choice for investors around the world. From thriving cities like Austin, Dallas, and Houston, Texas offers ample opportunities for high returns. Whether you’re new to real estate or a seasoned investor, understanding how to maximize your returns is crucial. The Lone Star State’s growing economy, diverse job market, and population growth contribute to its promising real estate landscape. These factors keep rental demands high and property values increasing, making it an attractive destination for investment. Moreover, Texas’s lack of state income tax makes it even more appealing, allowing investors to enjoy higher net returns. In this article, you’ll discover valuable tips to help you make the most of your investments. We’ll cover practical strategies, key market insights, and realistic goal-setting tips that cater to both beginners and experienced investors. Whether you’re a high net worth individual, a self-directed IRA holder, or part of a real estate investment club, these tips will help you navigate the Texas market more effectively. By the end, you’ll be equipped with the knowledge you need to make informed investment decisions and achieve higher returns in the Texas residential real estate market. The Potential of Texas Real Estate: An Overview Texas’s residential real estate market is currently one of the hottest in the United States. Cities like Austin, Dallas, and Houston are experiencing rapid growth, with increasing demand for housing driven by a booming economy and job market. This demand creates an excellent opportunity for investors looking for high returns on their investments. Texas is attractive to both domestic and international investors due to its strong economic fundamentals. The state’s low cost of living, lack of state income tax, and business-friendly policies further enhance its appeal. These factors make Texas a desirable location for people to move to, increasing the need for residential properties and driving up property values and rental income. Investing in Texas real estate can offer significant benefits, but it requires an understanding of the market dynamics. By selecting the right properties in growing neighborhoods, leveraging available tax benefits, and using strategic financing options, investors can maximize their returns. Whether you’re new to real estate or an experienced investor, knowing the ins and outs of the Texas market can help you make informed decisions and achieve your financial goals. Essential Concepts Simplified To succeed in real estate investing, it’s important to understand some key concepts. Here are a few terms that every investor should know: Cash Flow – Cash flow is the money you have left over from rental income after paying your expenses. Positive cash flow means you’re making a profit each month, while negative cash flow indicates a loss. Appreciation – Appreciation refers to the increase in property value over time. Properties in high-growth areas tend to appreciate more quickly, providing potential profit when you sell the property. Return on Investment (ROI) – ROI measures the profitability of an investment, calculated as a percentage of your initial investment. A higher ROI indicates a more profitable investment. To calculate ROI, divide your annual returns by the total investment cost and multiply by 100. Understanding these concepts can help newer investors make better decisions. For example, selecting properties with positive cash flow ensures ongoing profits, while properties with strong potential for appreciation increase long-term wealth. Learning these basics lays the groundwork for more advanced strategies and successful real estate investing. Local Market Insights When investing in Texas real estate, it’s important to understand the unique characteristics of different cities or regions. Each has its own growth patterns and rental demands. Here are key insights into some of Texas’s top residential real estate markets: Houston: Houston’s real estate market is thriving thanks to its strong job market and diverse economy. The energy sector, healthcare, and tech industries drive demand for housing. Neighborhoods like Midtown, Montrose, and the Heights offer excellent opportunities for both rental income and property appreciation. High rental demand and lower property prices make Houston attractive for investors looking for positive cash flow. Dallas: Dallas continues to grow with a booming tech industry and a robust job market. Areas like Uptown, Deep Ellum, and Bishop Arts District are popular due to their entertainment options and proximity to business districts. Investors can find properties with strong appreciation potential and good rental yields. The city’s investment potential is bolstered by a steady influx of young professionals seeking rental properties. Austin: Austin is known for its vibrant tech scene and cultural appeal. This attracts a steady stream of new residents and renters. Popular neighborhoods like East Austin, South Congress (SoCo), and Zilker offer profitable investment opportunities. Though property prices are higher, the potential for appreciation and stable rental demand make Austin a top pick. Its ongoing population growth and low unemployment rate contribute to a robust real estate market. Investors should focus on these high-growth areas to maximize returns, carefully researching each city’s trends and demographics to make informed decisions. Achieving Realistic Investment Goals Setting and achieving realistic investment goals is crucial for success in real estate. Here are some tips to guide you: Set Achievable ROI Targets: Before investing, define what a successful return on investment looks like for you. Consider factors like property value growth, rental yields, and overall market conditions. A common target for new investors is an ROI of 8-12%. Emphasize Patience: Real estate investing is not a get-rich-quick scheme. It requires patience and a long-term perspective. It may take several years for property values to appreciate significantly or for rental income to reach its full potential. Experienced investors understand the importance of holding on to properties for long-term gains. Regularly Evaluate Your Portfolio: Keep an eye on market trends and evaluate your investment portfolio regularly. Adjust your strategies as needed to ensure you are on track to meet your goals. This could mean selling underperforming properties or reinvesting in higher-growth areas. By setting realistic goals and maintaining patience, investors can build a profitable portfolio over time, minimizing risks

The Power of Real Estate Syndication: Pooling Resources for Bigger Returns

Real estate syndication is a strategy where multiple investors pool their resources to invest in larger, more profitable projects. By combining funds, investors can access premium properties that might be out of reach individually. This approach allows for shared risk, diversification, and the potential for higher returns. This guide will help you navigate the basics of real estate syndication, the benefits of pooling capital, and the right strategies to ensure your ventures succeed. Let’s explore how you can maximize returns and growth through intelligent syndication investments. Understanding Real Estate Syndication Definition and Basic Concept Real estate syndication allows multiple investors to pool their money and resources to buy more significant properties. This method will enable individuals to invest in substantial real estate projects they couldn’t afford alone. Everyone puts in money, and the profits are shared based on their contributions. It’s like forming a team where each player has a part in the game’s success. Roles of Key Participants There are two leading roles in real estate syndication: the syndicator and the investors. The syndicator finds the property, arranges the deal, and manages the project. They handle everything from purchasing to managing the property. Investors provide the capital but stay hands-off in the daily operations. They rely on the syndicator to make the right decisions to ensure investment returns. Types of Syndication Structures There are different ways to structure a syndication deal, depending on the project’s and investors’ needs. Common structures include: Joint Ventures: Two or more parties share control and profits. Limited Partnerships: Investors act as limited partners, providing money but not getting involved in management. Limited Liability Companies (LLCs): This structure limits investors’ liability to their investment amount. Each structure has advantages, so choosing the right one depends on the specific project and the investors’ goals. Benefits of Pooling Investor Capital Increased Purchasing Power Pooling capital allows investors to buy bigger and better properties. Pre-retirees and recent retirees can benefit from investing in high-quality real estate without needing large sums of money. Instead of buying a small property alone, you can own a part of a larger, more valuable project. This opens up better investment opportunities and the potential for higher returns. Shared Risk and Diversification Sharing investment risk is a significant advantage of real estate syndication. High-net-worth individuals and retirement planners can spread risk across different properties and markets. If one property doesn’t perform well, the impact is less severe because the risk is divided among multiple investors. Diversification improves the chances of overall success and stability. Access to Larger, More Profitable Projects By pooling funds, investors gain access to more extensive and lucrative projects. Real estate investment clubs and associations can now invest in properties like large apartment complexes or significant residential developments. These projects often yield higher returns, making the investment more attractive. Self-directed IRA holders and expatriates can also benefit from incorporating high-value properties into their investment portfolios. Pooling resources through syndication creates opportunities for everyone involved. By investing together, individuals can achieve more than they would alone. How to Structure a Syndication Deal Steps to Initiate a Syndication Starting a real estate syndication involves several key steps. First, identify a profitable property. Do thorough research to find a location that promises good returns. Once identified, create a detailed investment plan that outlines costs, expected returns, and timelines. Next, a legal entity, such as an LLC, must be formed to handle the syndication. This protects both the syndicator and the investors. Finally, present the plan to potential investors, highlighting the deal’s benefits and structure. Legal and Financial Considerations Legal and financial aspects are crucial in setting up a syndication. Work with a real estate lawyer to draft your syndication agreement, ensuring it complies with all federal and state regulations. This agreement should explain each investor’s role, profit distribution, and exit strategies. On the financial side, set up transparent bookkeeping systems to track all investments, expenses, and returns. Transparency is critical to maintaining investor trust. Creating a Comprehensive Syndication Agreement A well-crafted syndication agreement is the backbone of a successful syndication. It should detail the terms of the investment, including how and when returns are distributed. Include clauses that address potential risks and how they will be mitigated. Ensure the agreement outlines the responsibilities of both the syndicator and the investors, ensuring everyone knows their role. This document should leave no room for confusion, protecting all parties involved. Effective Strategies for Successful Syndication Building a Trustworthy Team Success in real estate syndication depends on having a reliable team. Hire experienced professionals like real estate agents, property managers, and contractors. Their expertise will help them make informed decisions. Trustworthy team members ensure the project runs smoothly and efficiently. Entrepreneurs and individual investors can benefit from a strong team, as it supports successful investment ventures. Finding and Attracting Investors Attracting the right investors is critical—network with potential investors at real estate conferences, seminars, and online forums. High-net-worth individuals and retirement planners are often looking for new opportunities. Create a compelling investment pitch that clearly shows the benefits and potential returns. Use simple language and straightforward examples to explain complex details. A clear and attractive pitch increases the chances of securing the needed capital. Ongoing Communication and Transparency with Investors Consistent and honest communication is vital to retaining investor trust. Provide regular updates on the project’s progress, financial performance, and any issues. Use newsletters, emails, and online portals to keep all investors informed. Pre-retirees, recent retirees, and self-directed IRA holders will appreciate the transparency, which helps them feel secure in their investments. Keeping investors in the loop fosters a strong relationship and paves the way for future collaborations. Real estate syndication is a powerful tool for pooling resources and achieving bigger returns. Understanding how syndication works, who the key players are, and the benefits of combining capital can help you make more informed investment decisions. Structuring a syndication deal requires careful planning, legal safeguards, and apparent financial oversight. Practical strategies, such as building a strong team, attracting

How to Attract Accredited Investors for Your Real Estate Projects

Attracting accredited investors for your real estate projects can make a huge difference in funding and advancing your ventures. These investors, who meet specific income or net worth thresholds, can provide the financial muscle needed to take your projects to the next level. Knowing how to reach and appeal to them is vital to your success in real estate investment. This article will walk you through actionable steps to attract and engage accredited investors seamlessly. Whether you’re a seasoned investor or just starting, these strategies will help you secure the backing you need. Let’s dive in and explore how to make your real estate projects stand out to accredited investors. Showcase Your Track Record and Credibility Highlight Past Projects and Successes Showcasing your successful past projects is crucial to attracting accredited investors. Highlight projects that have met or exceeded expectations. Provide clear and simple details on how these projects were executed, the timeline, and the returns generated for investors. This helps build confidence in your ability to manage and deliver successful real estate ventures. Provide Detailed Case Studies and Performance Metrics Detailed case studies can provide deeper insights into your previous successes. Include performance metrics such as ROI (Return on Investment), occupancy rates, and revenue growth. Graphs and charts can make these metrics easy to understand. By breaking down the numbers, you demonstrate transparency and analytical skills essential to investors. Obtain and Display Testimonials from Previous Investors Testimonials from previous investors can significantly enhance your credibility. Reach out to past investors and ask for their feedback. Display these testimonials prominently in your presentations and on your website. Positive reviews from satisfied investors can reassure potential accredited investors about partnering with you. Create a Compelling Investment Proposal Detail the Project Scope and Financial Projections A compelling investment proposal should detail the project scope and financial projections. Break down the project steps, the budget, and the expected timeline. Include projected financial outcomes like rental income, appreciation rates, and overall ROI. Easy-to-understand charts and forecasts can convey this information effectively. Highlight Unique Selling Points and Market Opportunities Projects should have unique selling points (USPs) and clear market opportunities. Highlight what sets your project apart. Whether it’s a prime location, innovative design, or potential for high returns, make sure these points are clear. Explaining the market demand and how your project meets this demand can attract serious attention from accredited investors. Specify Investor Benefits and Exit Strategies Specify the benefits for investors and outline possible exit strategies. Describe how investors earn returns through rental income, property sales, or other means. Offering multiple exit strategies can make the investment more appealing by showing that you have planned for various scenarios. This level of detail helps potential investors understand the value and security of their investment. Utilize Networking and Professional Platforms Attend Investment Conferences and Real Estate Meetups Investment conferences and real estate meetups are one effective way to meet accredited investors. These events gather industry professionals and potential investors in one place. Engaging with attendees, sharing information about your projects, and listening to their interests. Networking face-to-face helps build trust and establish meaningful connections. Leverage Online Platforms and Social Media for Investor Outreach Online platforms and social media are powerful tools to reach a broad audience of potential investors. Use LinkedIn to connect with accredited investors and share updates about your projects. Participate in real estate forums and groups to showcase your expertise. Regularly post engaging content on platforms like Twitter, Facebook, and Instagram. Highlight your projects, share your successes, and inform your audience about new opportunities. Join Real Estate Investment Clubs and Associations Joining real estate investment clubs and associations can provide valuable networking opportunities. These groups often consist of experienced investors looking for profitable ventures. Attend their meetings, participate in discussions, and share details about your projects. This can help you build relationships with potential investors and learn from their experiences. Offer Transparent Communication and Reporting Maintain Regular Updates and Progress Reports Maintaining regular updates and progress reports is crucial for building trust with accredited investors. Provide weekly or monthly updates on project milestones, financial performance, and challenges. This transparency reassures investors that you are committed to keeping them informed and involved. Ensure Easy Access to Financial and Project Data Make it easy for investors to access financial and project data. Create a secure online portal where investors can view up-to-date information about their investments. Include details such as financial statements, project timelines, and status reports. Easy access to data helps investors feel confident and secure in their investments. Foster Strong Relationships through Consistent Communication Fostering strong relationships with investors involves consistent and open communication. Respond promptly to their inquiries, provide honest updates, and seek their feedback. Building a rapport with your investors can lead to long-term partnerships and continued support for future projects. Conclusion Attracting accredited investors to your real estate projects requires a combination of credibility, compelling proposals, effective networking, and transparent communication. You can draw genuine interest from certified investors by showcasing your track record, presenting clear investment proposals, leveraging professional networks, and maintaining open lines of communication. Elysium Real Estate Investments is dedicated to helping you succeed in your real estate ventures. Our comprehensive real estate strategies can guide you in attracting the right investors and making informed decisions. Ready to take your real estate projects to the next level? Contact Elysium Real Estate Investments today and discover how we can assist you in maximizing your returns and achieving your investment goals. Legal Disclaimer: The information in this article, “How to Attract Accredited Investors for Your Real Estate Projects,” is for informational purposes only and does not constitute legal, financial, or investment advice. Readers should conduct their due diligence and seek professional counsel tailored to their circumstances. Elysium Real Estate Investments LLC is not liable for any direct or indirect outcomes resulting from reliance on the information herein. Investment decisions involve risks, including the potential loss of capital. LEARN TO INVEST WITH US. We accept queries from accredited

Top 5 Texas Cities for Real Estate Investment in 2025

Are you all thinking about investing in Texas real estate? Then you’re on the right track! Texas is booming, and it’s no secret why. With gorgeous landscapes, strong economies, and family-friendly communities, the Lone Star State is a hotspot for real estate. Expats, high-net-worth individuals, and even pre-retirees see Texas as a land of opportunities for growing their residential property portfolios. Whether you’re an individual investor, part of a real estate investment club, or managing a self-directed IRA, there’s something for everyone in Texas. Let’s dive into the top cities in Texas to consider when planning your next real estate investment. Buckle up and discover why these cities are grabbing so much attention! Discover Houston: A Booming Real Estate Market Economic Growth and Job Opportunities Houston isn’t just about cowboys and rodeos; it’s a powerhouse of economic growth—industries like energy, healthcare, and aerospace fuel the city’s strong job market. Job opportunities bring more people looking for housing, making Houston a hot spot for real estate investment. It’s a win-win for investors. More jobs mean more folks needing places to live, ensuring steady rental income. Affordable Housing and Family-Friendly Neighborhoods Houston also boasts affordable housing compared to other major U.S. cities. You can find well-priced homes in neighborhoods with great schools and family amenities. This affordability attracts families and young professionals, offering stable rental returns. Investing in Houston is like hitting the jackpot for pre-retirees and recent retirees. They can diversify their portfolios without breaking the bank. Investment Prospects for High Net Worth Individuals and Real Estate Investment Clubs Houston is a goldmine for high-net-worth individuals and real estate investment clubs. Luxury properties and upscale neighborhoods offer the potential for high returns. Real estate clubs pooling their resources can benefit from Houston’s property appreciation. Teaming up on investment projects in prime areas can yield substantial profits. Why Austin Is a Hot Spot for Residential Investment Tech Industry Influence and Population Growth Austin’s tech scene is buzzing, you all! It’s often called “Silicon Hills” because of the many tech companies setting up shop. This tech boom attracts professionals who need housing. As Austin keeps growing, so do real estate opportunities. Entrepreneurs and individual investors find Austin’s dynamic market perfect for expanding their portfolios. Attractive Rental Yields for Self-Directed IRA Holders Self-directed IRA holders love Austin for its rental yields. Properties near tech hubs or universities fetch high rents, and buying a property in Austin can lead to a solid monthly income. The city’s vibrant culture and lifestyle make it attractive to long-term renters, making Austin an intelligent choice for those looking to boost their IRA returns with a steady rental income. Ideal for Entrepreneurs and Individual Investors Austin is a dream come true for entrepreneurs and individual investors. The city’s growing population means there’s always a demand for housing. Investing here offers both immediate rental income and long-term appreciation. Small to medium real estate investment groups also find Austin appealing for starting or scaling operations. Austin’s real estate market is packed with potential. Whether you’re an expat, a high-net-worth individual, or just starting in real estate, Austin provides a fertile ground for your investments. San Antonio: A Stable Market with Strong Growth Potential Historical Appeal and Cultural Vibe San Antonio is rich in history and culture. Its unique charm makes it appealing to both residents and investors. Historical neighborhoods, landmarks, and vibrant downtown areas draw people from all over. For real estate professionals and financial advisors, highlighting San Antonio’s cultural attractions can attract diverse investors looking to capitalize on the city’s growing popularity. Diversification Opportunities for Real Estate Professionals and Financial AdvisReal estate professionals and financial advisors find San Antonio attractive for its stable market and strong growth potential. The city offers affordable and upscale properties, allowing investors to diversify their portfolios effectively. Whether working with pre-retirees looking to diversify their retirement investments or advising high-net-worth individuals on wealth management strategies, San Antonio presents various opportunities for portfolio diversification. Affordable Entry Points for Pre-Retirees and Recent Retirees San Antonio offers affordable entry points for pre-retirees and recent retirees. The city’s affordable housing makes it easier for them to invest without stretching their budgets. Investing in San Antonio can provide steady income and potential appreciation for those looking to diversify their retirement portfolios with real estate. The city’s family-friendly neighborhoods and recreational facilities make it an ideal place to settle and invest. Explore Emerging Markets in Texas Fort Worth: A Hidden Gem with Promising Returns Fort Worth is fast becoming a hidden gem for real estate investors. The city’s ongoing community development and infrastructure enhancements are driving growth. Property managers and small real estate investment groups can benefit from Fort Worth’s increasing property values. New developments and upgrades in transportation, schools, and parks make Fort Worth an attractive option for families and investors. Community Development and Infrastructure Enhancements Community development and infrastructure enhancements in Fort Worth are transforming the city. New projects and investments in public services are boosting the quality of life, creating more opportunities for real estate investment for property managers and small real estate investment groups. Focusing on Fort Worth can lead to promising returns. Perfect for Property Managers and Small Real Estate Investment Groups Fort Worth is perfect for property managers and small real estate investment groups. The city’s mix of urban and suburban areas provides various investment options. Real estate groups pooling their resources can target different property types, from single-family homes to multi-family units, catering to diverse investment needs. Plano: The Rising Star for Family Living Excellent Schools and Safe Neighborhoods Plano is known for its excellent schools and safe neighborhoods. Families looking for a great place to live choose Plano for its top-rated educational institutions and community safety. Real estate investors targeting high-net-worth individuals and expats can find lucrative opportunities in Plano’s family-friendly environment. Investing in rental properties in such areas can ensure high demand and steady returns. Opportunities for High Net Worth Individuals and Expats High-net-worth individuals and expats find Plano attractive for its

Utilizing Credit Lines for Your Real Estate Investing Portfolio in Texas

Building a real estate portfolio in Texas can be an exciting adventure. One way to do this is by utilizing credit lines. Credit lines offer flexible financing options that can help you buy more properties quickly. They are useful for various types of investors, including pre-retirees, high net worth individuals, and real estate investment clubs. Understanding how credit lines work is essential. Credit lines can be secured or unsecured, and each type has its specific features. Secured credit lines are backed by an asset, usually a property, making them less risky for the lender. Unsecured credit lines don’t require collateral, but they typically come with higher interest rates. Both options have their pros and cons, and knowing which is right for you will help you make better financial decisions. Using credit lines can give you the leverage you need to scale your real estate investments. This method allows for quick access to funds, making it easier to seize new opportunities as they arise. Whether you are an expatriate looking to invest in Texas or a retirement planner seeking options for clients, understanding how to use credit lines can be a beneficial strategy for expanding your portfolio. Understanding Credit Lines for Real Estate Investing in Texas Credit lines are a type of financing you can tap into whenever you need funds. They operate much like a credit card, allowing you to withdraw money up to a certain limit. For real estate investors, credit lines can be an effective way to finance additional property purchases or renovations. There are two main types of credit lines: secured and unsecured. A secured credit line uses an asset, like a property, as collateral. This usually results in lower interest rates because the lender has security in case you default. High net worth individuals and retirement planners often prefer secured lines because of these lower costs. Unsecured credit lines don’t require any collateral. They are riskier for lenders, so they come with higher interest rates. Entrepreneurs and individual investors might use unsecured lines for their flexibility, even though they are costlier. How to Secure a Credit Line for Real Estate Investments Securing a credit line involves a few steps. Start by checking your credit score. A higher score increases your chances of getting approved. Most lenders look for a score of 700 or above. If your score is lower, take steps to improve it before applying. Next, gather your financial documents. Lenders will want to see proof of income, bank statements, and details about your existing assets. High net worth individuals and real estate professionals usually have an easier time compiling this information. Then, choose a lender. Banks, credit unions, and private lenders offer credit lines. Each has different terms, so compare rates, fees, and terms before making a decision. Once you’ve selected a lender, fill out the application. Be honest and thorough, as any discrepancies can delay approval. After submitting your application, expect a review period that can last from a few days to a few weeks, depending on the lender. Finally, if approved, you’ll receive your line of credit. Use it wisely to grow your real estate portfolio and always make timely payments to maintain a good credit standing. Benefits of Utilizing Credit Lines for Expanding Your Texas Real Estate Portfolio Using credit lines for real estate investments offers several benefits. One of the main advantages is flexibility. You can access funds quickly, allowing you to act fast on new opportunities. This is valuable for entrepreneurs and individual investors who need to move swiftly to acquire prime properties. Another benefit is the ability to manage cash flow better. You only pay interest on the amount you draw, not the entire credit line. This can save money compared to traditional loans. Pre-retirees and high net worth individuals often find this feature helpful for managing investment costs efficiently. Credit lines also allow for portfolio diversification. By having easy access to funds, you can invest in different types of properties, spreading your risk. Real estate investment clubs and associations can use credit lines to pool resources and invest in multiple properties, enhancing their investment strategy Key Considerations and Risks When Using Credit Lines for Real Estate While credit lines offer many benefits, it’s important to consider the risks and essential factors. One key factor is interest rates. These can vary, and sometimes they may be higher than those of traditional loans. Self-directed IRA holders and expatriates should compare rates across different lenders to find the best deal. Another risk is the potential for over-borrowing. It can be tempting to draw more than needed, which can lead to financial strain. It’s crucial to create a budget and stick to it. Property managers and developers need to ensure they don’t overstretch their financial limits. Additionally, credit lines often have variable interest rates. This means your payments can increase if the rates go up. Paying attention to market trends can help you anticipate these changes. Retirement planners and financial advisors should advise clients on the potential for fluctuating interest rates. Conclusion Credit lines can be a powerful tool for expanding your Texas real estate portfolio. They offer flexibility, better cash flow management, and the ability to diversify your investments. However, it’s essential to understand the risks and manage your borrowing carefully. For pre-retirees, high net worth individuals, and other investors, the key to success lies in informed decision-making. Knowing the benefits and understanding the potential pitfalls will help you maximize your returns and grow your portfolio wisely. Ready to take the next step in growing your real estate investments? Contact Elysium Real Estate Investments LLC today for expert advice and tailored strategies to help you succeed as a real estate investor in Texas. Legal Disclaimer: The information provided in this article, “Utilizing Credit Lines for Your Real Estate Investing Portfolio in Texas,” is for general informational purposes only. It is not intended as financial, legal, or investment advice. Before utilizing credit lines or engaging in real estate investments, please

The Pros and Cons of Seller Financing for Real Estate Investments in Texas

Seller financing is a unique option for buying and selling homes. In this method, the seller gives the buyer a loan to buy the property. Instead of going to a bank, the buyer pays the seller directly over time. This can be helpful for both the buyer and the seller, making the process faster and more flexible. For pre-retirees and recent retirees looking to diversify their portfolios, seller financing can be a good opportunity. It provides a steady income stream for sellers and offers an alternative route for buyers who may not qualify for traditional loans. High net worth individuals also find it appealing as part of their broader investment strategy. Self-directed IRA holders and real estate investment clubs may discover seller financing to be quite beneficial. It opens up new ways to invest in real estate that they might not have considered before. Similarly, expatriates and overseas investors can find a foothold in the American property market through this method. Understanding the pros and cons of seller financing is crucial for making informed decisions. This article will help you explore these aspects, giving you the knowledge to decide if seller financing is right for your real estate investment needs. Understanding Seller Financing in Texas Seller financing is when the seller of a property acts as the lender to the buyer. Instead of the buyer getting a loan from a bank, they make payments directly to the seller over time. This arrangement is also called owner financing or seller carryback financing. The process starts with an agreement between the buyer and seller. They agree on the sales price, interest rate, and repayment schedule. The buyer usually provides a down payment, and the remaining balance is paid over time. The terms are flexible and can be tailored to meet the needs of both parties. One common form of seller financing is a promissory note. This is a legally binding document that outlines the terms of repayment. The seller holds the note until the buyer pays off the loan. The buyer gets immediate possession of the property but does not receive the title until the loan is fully paid. Seller financing can be beneficial in many situations. For those who struggle with getting traditional bank loans due to credit issues, it provides an alternative. Pre-retirees, expatriates, and self-directed IRA holders might find this option particularly useful. Understanding the basics of seller financing helps these groups make informed decisions. Advantages of Seller Financing for Investors Easier Qualifying Process: Unlike traditional loans, seller financing has fewer qualifying requirements. This makes it easier for buyers with less-than-perfect credit to purchase a home. Pre-retirees and small to medium real estate investment groups can take advantage of this to diversify their portfolios. Flexible Terms: Seller financing offers flexible terms compared to bank loans. The buyer and seller can negotiate the interest rate, down payment, and repayment schedule. This flexibility can benefit high net worth individuals and retirement planners looking for tailored investment strategies. Faster Closing: Transactions can be completed faster since there is no need for bank approval. This speed can be advantageous for real estate investment clubs and high net worth individuals who want to secure deals quickly. Investment Opportunities: For sellers, offering financing can attract more buyers and potentially sell the property at a higher price. Investors owning multiple properties can use this method to increase their income streams. Tax Benefits: Sellers might enjoy tax benefits since payments are received over time. This can spread out capital gains taxes, making it appealing for investors in higher tax brackets. Improved Cash Flow: Seller financing can provide steady cash flow for sellers. They receive regular payments, which can be used for other investments or personal needs. This is especially valuable for pre-retirees and recent retirees who want to maintain a steady income. These benefits make seller financing an attractive option for various investors. Understanding these advantages helps investors make the best possible decisions for their financial goals. Drawbacks of Seller Financing in Texas Real Estate Risk of Default: One of the biggest risks is that the buyer may default on the loan. This means they could stop making payments, leaving the seller in a tough spot. Pre-retirees, expatriates, and high net worth individuals need to consider this risk, especially if they rely on the payments for their cash flow. Limited Liquidity: Seller financing can tie up your funds for several years. Sellers might not have access to the full property value right away. This can impact real estate investment clubs and self-directed IRA holders who may need liquidity for other investments. Management Burden: Acting as a lender means taking on administrative tasks. These can include collecting payments, handling late payments, and dealing with foreclosure if necessary. Property managers and real estate professionals might find these tasks time-consuming and challenging. Appraisal and Legal Issues: Properly assessing the value of the property and writing up a legally binding contract can be complicated. Failing to do so can lead to legal troubles. High net worth individuals and small to medium real estate investment groups should seek legal advice to avoid pitfalls. Interest Rate Risk: If interest rates go up after the agreement is made, the seller could miss out on higher returns that they could have earned from other investments. Retirement planners and financial advisors need to keep this in mind when advising clients. Understanding these drawbacks is essential to making an informed decision about seller financing. By weighing these risks, investors can better decide if this method aligns with their goals. Tips for Successful Seller Financing Transactions Do Thorough Background Checks: Always check the buyer’s credit score and financial history. This helps reduce the risk of default. Retirement planners and financial advisors should recommend this step to their clients to ensure future payments. Set Clear Terms: Make sure all terms are clearly outlined in the contract. Include details like the interest rate, repayment schedule, and consequences for missed payments. High net worth individuals and investment clubs will find

Leveraging Equity in Your Investment Properties: How to Scale Faster

Leveraging equity in your investment properties can be a powerful way to grow your real estate portfolio faster. Equity is the difference between the property’s market value and the amount owed on it. Tapping into this equity allows you to get funds to buy more properties without selling your existing assets. Many investors, including pre-retirees, high net worth individuals, and real estate investment clubs, use their property equity to scale quickly. This method offers the benefit of expanding your investments without draining your savings or liquid assets. By leveraging equity, you can make your money work harder for you. Understanding how to access and use your equity effectively is key. From taking out home equity loans to cash-out refinancing, there are several ways to unlock your property’s value. Being aware of the risks and benefits can help you make informed decisions. Whether you’re an expatriate looking to diversify your portfolio or a self-directed IRA holder seeking smart investment strategies, knowing how to leverage equity can be a game-changer for your financial growth. Understanding Equity: The Basics and Importance Equity is a crucial concept for real estate investors. It’s the difference between your property’s current market value and the amount you owe on your mortgage. For example, if your property is worth $500,000 and you owe $300,000, your equity is $200,000. This equity can be a powerful tool for pre-retirees, high net worth individuals, and real estate investment clubs aiming to expand their portfolios. Building equity over time happens through property value appreciation and paying down your mortgage. As you make mortgage payments, your loan balance decreases, increasing your equity. Similarly, if property values in your area rise, your equity also grows. For retirement planners, financial advisors, and self-directed IRA holders, using this growing equity can be a strategic way to invest further without depleting liquid assets. Knowing your equity is important because it allows you to leverage it for new investments. Real estate professionals, expatriates, and entrepreneurs can use equity to secure financing for additional properties, thus scaling their investments more quickly. By tapping into this resource, you can accelerate your investment strategy while keeping your financial risk in check. How to Tap Into Your Equity: Proven Methods There are several ways to access the equity in your investment properties. Each method has its pros and cons, and it’s important to choose the one that best fits your financial goals and risk tolerance. Here are some common methods: Home Equity Loan: This is a second mortgage taken out against your property. It provides a lump sum of money that can be used to buy another property. The loan is repaid over time with fixed monthly payments. This option can be ideal for small to medium real estate investment groups looking for a straightforward way to access funds. Home Equity Line of Credit (HELOC): A HELOC works like a credit card. You can borrow money as needed up to a certain limit. The interest rate is usually variable. Real estate investment clubs and individual investors might find this option flexible and convenient. Cash-Out Refinance: This involves refinancing your existing mortgage for more than you currently owe and taking the difference in cash. For high net worth individuals and retirement planners, this can be a method to obtain a large sum of money at potentially lower interest rates compared to other loan types. Cross-Collateralization: This involves using multiple properties as collateral to secure a single loan. It’s useful for those with a large portfolio of properties, like real estate professionals or property managers, who want to leverage multiple assets at once. Understanding these methods helps you make an informed decision about how to best leverage your equity. Whether you’re an expatriate looking to diversify or an entrepreneur aiming to scale quickly, these options provide pathways to grow your real estate investments efficiently. Strategies for Reinvesting Equity to Scale Your Portfolio Reinvesting equity wisely can help you expand your real estate portfolio quickly. Different strategies work better for different types of investors, so consider what suits your financial goals and risk tolerance. Here are some practical strategies: Buy-and-Hold: Purchasing properties with the intention of renting them out long-term. For pre-retirees and high net worth individuals, this strategy offers steady income and capital appreciation over time. Fix-and-Flip: Buying properties that need renovation, improving them, and then selling for a profit. This can be effective for small to medium real estate investment groups and entrepreneurs who want quicker returns. Multifamily Properties: Investing in multifamily buildings can provide multiple rental incomes from a single property. Retirement planners and financial advisors could find this appealing for clients looking to diversify income sources. Short-term Rentals: Using platforms like Airbnb to rent out properties on a short-term basis. Expatriates and overseas investors often find this strategy attractive for maximizing returns in tourist-heavy areas. Each strategy has its own set of advantages. By carefully choosing the right approach, you can use your equity to build a robust, diversified portfolio and achieve faster growth. Risks and Benefits: What You Need to Know Leveraging equity can offer many benefits but it’s also essential to understand the risks involved. Knowing both sides helps in making better decisions for your investment strategy. Benefits: – Increased Buying Power: Accessing equity allows you to purchase additional properties without using savings, especially useful for high net worth individuals and self-directed IRA holders. – Tax Advantages: Interest on loans taken out using home equity can be tax-deductible, offering a financial perk for pre-retirees and retirement planners. – Portfolio Diversification: Using equity to invest in different property types or locations helps spread risk. Real estate professionals and investment clubs can benefit from a diversified portfolio. Risks: – Market Fluctuations: Property values can drop, affecting your equity. This risk is particularly relevant for expatriates and self-directed IRA holders investing in foreign markets. – Increased Debt: Taking on more loans means higher monthly payments, which could strain your finances if rental income isn’t steady. Entrepreneurs and small real estate groups

The Importance of Due Diligence: How to Avoid Bad Real Estate Deals

Making a smart real estate investment involves more than just finding a good property. Conducting due diligence is crucial to avoid costly mistakes. Whether you are a pre-retiree, a high net worth individual, or part of a real estate investment club, understanding due diligence will help you make informed decisions. Due diligence means thoroughly checking a property’s legal, financial, and physical aspects before buying. This process helps identify potential risks and ensures you are making a sound investment. For self-directed IRA holders and expatriates, due diligence can safeguard against unforeseen issues and protect your investment. Learning to conduct due diligence effectively is important for both new and experienced investors. By understanding what to look for, you can avoid bad deals and maximize your returns. This knowledge is key for retirement planners, real estate professionals, and small to medium investment groups seeking to expand or optimize their portfolios. Taking the time to perform thorough due diligence will help you invest confidently and successfully. Legal Due Diligence: Protecting Your Investment Legal due diligence is key to safeguarding your real estate investment. This process involves checking legal documents and regulations related to the property. For pre-retirees, high net worth individuals, and real estate investment clubs, legal due diligence ensures there are no legal issues that could affect their investment. Start by verifying the property title. Make sure the seller has clear ownership and the right to sell. Check for any liens or encumbrances that might be on the property. Liens are legal claims against the property for unpaid debts, and they can complicate your purchase. Next, review zoning laws and land use regulations. Ensure the property complies with local zoning laws and can be used for your intended purpose. For self-directed IRA holders and expatriates, understanding these rules is crucial when investing in an unfamiliar area. Lastly, examine any existing leases or tenant agreements. If the property has tenants, read through their lease agreements. Know the terms and whether they align with your investment goals. For retirement planners and financial advisors guiding their clients, this step helps in assessing potential income from the property and future expenses related to tenant issues. Financial Evaluation: Assessing Property Value and Costs Financial evaluation means understanding the property’s value and the costs involved. This step helps high net worth individuals, real estate professionals, and small investment groups avoid overpaying for a property. Start by looking at comparable sales, or “comps.” These are recently sold properties similar to the one you’re considering. Comps help you gauge the market value. For example, if similar homes in the area sold for $300,000, you have a benchmark for your investment. Next, calculate the total cost of ownership. This includes the purchase price, closing costs, ongoing maintenance, property taxes, and insurance. For entrepreneurs and small to medium investment groups, knowing these costs helps in budgeting and financial planning. Another key step is evaluating the property’s cash flow potential. Estimate the rental income and subtract operating expenses. If the rental income is $2,000 per month and expenses are $1,200, your monthly cash flow is $800. This helps real estate investment clubs and associations understand the property’s income potential. Lastly, review funding options. Whether financing through a mortgage or using cash, understand the implications. For high net worth individuals, securing favorable loan terms can maximize returns. For real estate professionals advising clients, understanding financing helps in guiding them to make informed decisions. Physical Inspections: Uncovering Potential Issues Physical inspections are crucial to identify potential problems with a property. Skipping this step can lead to costly surprises later. For high net worth individuals, expatriates, and real estate investment clubs, thorough inspections help ensure a sound investment. Hire a professional home inspector to assess the property. The inspector will check the structure, roof, plumbing, electrical systems, and more. This detailed inspection reveals any defects or necessary repairs. For small to medium real estate investment groups, understanding these issues upfront helps in budgeting for repairs and maintenance. Additionally, consider specialty inspections if needed. For example, a pest inspection can identify termite damage, while a sewer inspection checks for pipe issues. Entrepreneurs and individual investors should not overlook these inspections, as they can prevent major problems down the road. Review the final inspection report carefully. Note any red flags or required repairs, and use this information in negotiations. For real estate professionals and property managers, understanding the inspection report is crucial when advising clients or planning future investments. Red Flags to Watch For: Warning Signs of Bad Deals Other Important Metrics: Vacancy Rate, Operating Expenses, and Rent Ratio Watching for red flags can help avoid bad investments. Knowing these warning signs is essential for pre-retirees, self-directed IRA holders, and retirement planners. – Unrealistic Promises: If something sounds too good to be true, it probably is. Be cautious of properties with extremely high return promises without clear justification. – Seller Pressure: High-pressure tactics to make a quick decision often indicate hidden issues. Take your time to evaluate the deal thoroughly. – Lack of Documentation: If the seller cannot provide proper records, such as property titles or maintenance history, it’s a red flag. Documentation is crucial for verifying the property’s background. – Unusually High Costs: Excessively high repair or operating costs compared to similar properties can signal hidden problems. Get a second opinion if costs seem out of line. Evaluating these red flags helps protect your investment. For expatriates and high net worth individuals, being mindful of these warning signs ensures a smart investment choice. Conclusion Conducting due diligence is crucial for successful real estate investments. Checking the legal, financial, and physical aspects of a property helps identify potential risks and ensures you make an informed decision. For pre-retirees, high net worth individuals, and retirement planners, understanding these steps is vital for protecting and maximizing your investment. Performing thorough inspections and paying attention to red flags can avoid costly mistakes. Knowing what to look for makes the investment process smoother and more secure. Entrepreneurs, self-directed IRA holders, and real

How to Analyze Rental Property Deals: Metrics Every Investor Should Know