Introduction

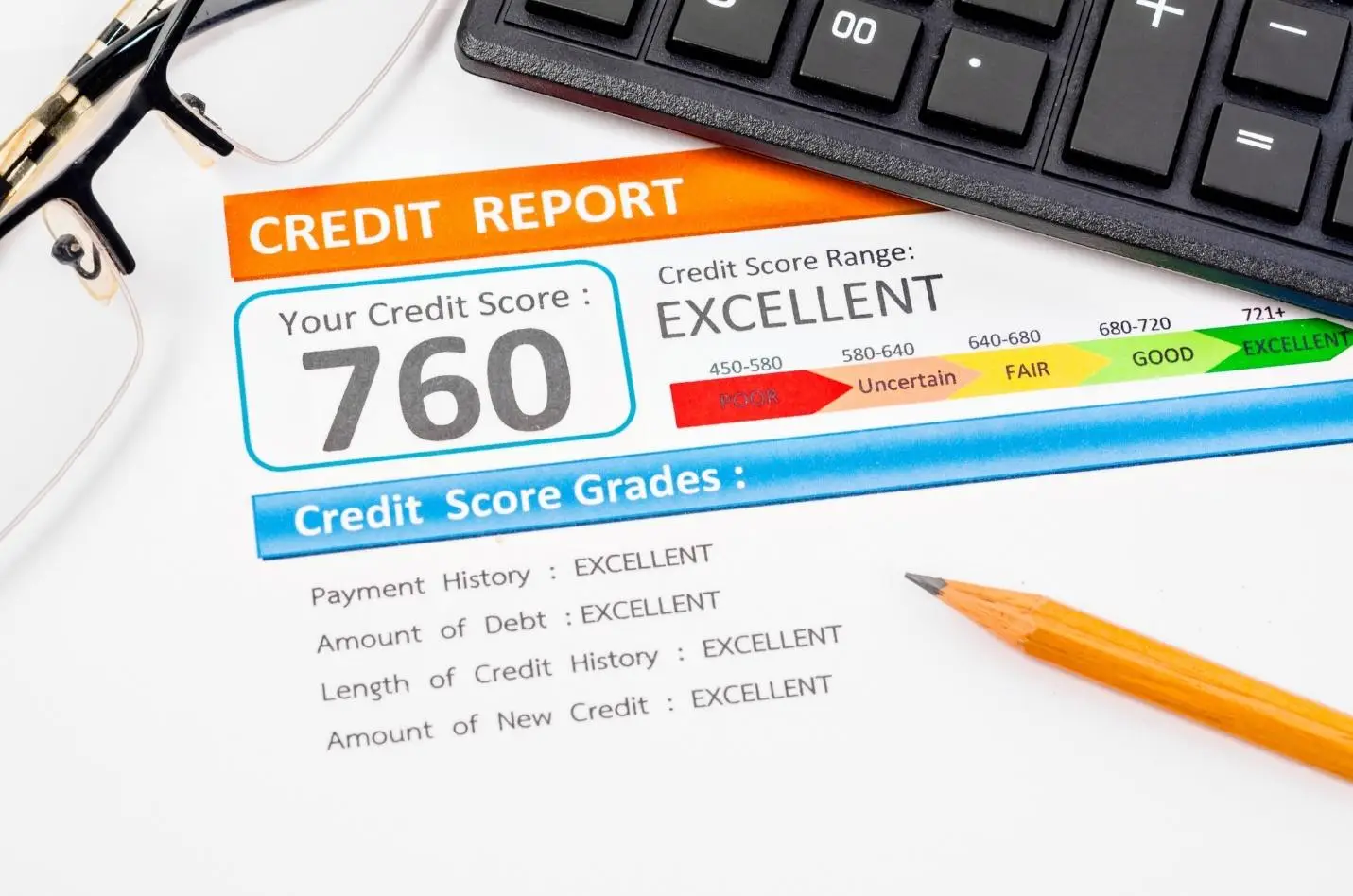

Understanding the influence of credit scores on real estate investment financing options in Texas is crucial for any investor looking to navigate this competitive arena. A credit score isn’t just a number—it’s a pivotal factor that lenders use to determine the terms, interest rates, and types of financing available to you. At Elysium Real Estate Investments LLC, we specialize in guiding investors through the complexities of real estate financing, emphasizing the role of credit health in securing favorable outcomes.

Whether you are a seasoned investor aiming to expand your portfolio or a newcomer setting your sights on the dynamic Texas real estate market, optimizing your credit score can open doors to better financing options and more lucrative deals. This article delves into how your credit score affects your real estate financing opportunities in Texas, offering expert insights to help you leverage your financial standing to its fullest potential. Let’s explore the essential connections between credit scores and real estate investment success.

Understanding Credit Scores and Their Impact on Financing

Credit scores are an essential element in the realm of financing, especially for real estate investments in Texas. A credit score can range from 300 to 850, where a higher score indicates stronger creditworthiness. This score influences not only the ability to secure financing but also the terms and interest rates offered. For high-net-worth individuals and self-directed IRA holders looking to invest efficiently, maintaining a high credit score is crucial as it could lead to more favorable loan terms with lower interest rates, thus enhancing the potential for significant returns on their real estate investments.

Types of Financing Affected by Credit Scores

1. Conventional Loans:

For real estate investment clubs and entrepreneurs, conventional loans are a common financing route impacted heavily by credit scores. These loans, not insured by federal agencies, often require higher credit scores. Investors with scores above 680 often enjoy better interest rates and lower down payment requirements, making it a cost-effective option for purchasing residential properties in Texas.

2. FHA Loans:

Ideal for individual investors and first-time homebuyers, FHA loans cater to those with lower credit scores, accepting scores as low as 500 with higher down payments. For scores 580 and above, borrowers can benefit from down payment requirements as low as 3.5%. This inclusivity allows broader access to real estate investments, particularly beneficial for those in real estate investment clubs who may be pooling resources for a collective investment.

3. Hard Money Loans:

Often used by property developers and real estate professionals aiming to renovate and flip properties quickly, hard money loans rely more on the property’s value than the borrower’s credit score. However, a better credit score can still lower interest rates and improve loan terms, making it an important consideration for developers looking to maximize project profitability.

Strategies to Improve Your Credit Score for Better Financing Options

To maximize financing options in real estate, maintaining or improving your credit score is key. Here are some effective strategies:

- Timely Payments: Ensure all loans, credit cards, and other financial obligations are paid on time. Late payments can significantly harm your credit score.

- Debt Management: Keep your credit card balances low relative to their limits; aim to use less than 30% of your available credit. High net worth individuals and retirement planners should particularly manage large debts efficiently to maintain their purchasing power in real estate.

- Regular Credit Check-Ups: Regularly checking your credit report for errors and discrepancies can prevent misinformation from damaging your score. Real estate professionals and brokers, vigilant in their transactions, should apply the same care to their personal and business credit reports.

- Credit History Length: The length of your credit history can impact your score. Keep old accounts open and in good standing to benefit from a longer credit history, which is especially beneficial for pre-retirees and recent retirees aiming to diversify their investment portfolios.

Credit Scores and Investment Opportunities for Various Investor Types

Different investor types, from expatriates to small to medium real estate investment groups, need to understand how their credit score might shape their investment opportunities. For example, overseas investors may need to establish credit within the U.S. if they are new to the market; strategies like secured credit cards or small personal loans might be initial steps.

For real estate investment clubs pooling resources, a collective approach to maintaining members’ good credit can be integral to securing sizable loans for larger or multiple property investments. Similarly, retirement planners and financial advisors should prioritize credit education for their clients to broaden their investment possibilities.

Navigating the Process with Expert Advice

Securing the right financing for real estate investment in Texas requires not just good credit but also a profound understanding of various loan options and market conditions. Real estate advisors like Elysium Real Estate Investments LLC can play a decisive role. They help investors interpret their credit scores in the context of their real investment goals, manage risk, and secure financing that aligns with their financial strategy. This expert guidance is invaluable for maximizing returns and achieving long-term success in the competitive Texas real estate market.

Secure Optimal Financing with Elysium Real Estate Investments LLC

In the dynamic landscape of Texas real estate, your credit score is much more than just a number—it’s a key that can unlock a myriad of investment opportunities. Whether you’re a seasoned investor or just starting out, understanding and enhancing your credit score is crucial in securing favorable financing options that align with your investment goals. At Elysium Real Estate Investments LLC, we provide expert guidance and strategic advice to ensure your financial profile supports your ambitions in real estate.

Ready to leverage your credit score for optimal investment success in Texas? Connect with our expert real estate investors at Elysium Real Estate Investments LLC today, and let us help you navigate the complexities of real estate financing with ease. Your journey to smarter investments and maximized returns begins here—let’s get started!

Disclaimer:

This article is provided for informational purposes only and does not constitute legal, financial, or professional advice. Elysium Real Estate Investments LLC makes no representations as to the accuracy, completeness, suitability, or validity of any information in this article and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis. It is recommended that readers seek independent advice from legal, financial, or other professionals regarding their specific situation and any actions they should take based on the information in this article. Elysium Real Estate Investments LLC does not endorse any products, services, or companies mentioned in this article.

LEARN TO INVEST WITH US.

We accept queries from accredited domestic and foreign investors seeking single and small multifamily investment opportunities.