Navigating the real estate investment landscape in the Lone Star State can seem like a daunting task, especially if you’re just dipping your toes into this potentially lucrative pool. From choosing the right properties to managing them effectively, there’s a lot to learn. But don’t worry, that’s where we come in. We’ve put together a comprehensive guide for beginners to help you understand the ins and outs of real estate portfolio management in Texas.

This guide is designed to be your roadmap in your journey to becoming a successful real estate investor in Texas. Whether you’re a native Texan or an out-of-state investor drawn by the state’s robust economy and diverse real estate opportunities, this guide will arm you with the knowledge you need to navigate the Texas real estate market confidently.

Remember, every great domestic and foreign accredited real estate investor started out as a beginner, and the journey to success is often filled with trials and errors. But with the right guidance and a willingness to learn, you can turn a challenging process into a rewarding experience.

Understanding Property Types in Texas

As previously mentioned, familiarizing yourself with the different types of properties available in the Texas residential market is the first step in successful property portfolio management. Single-family homes are the most common types of residential properties and often serve as an excellent starting point for domestic and foreign accredited investors.

They are relatively affordable and tend to appreciate in value over time. Townhouses are another popular investment choice, offering lower maintenance costs, and shared amenities for residents. Condominiums and apartment buildings provide multiple units for rent or sale under one roof, which can generate multiple income streams for investors.

To make informed decisions, research various factors, such as neighborhoods, school districts, access to transportation, and nearby amenities. Taking these factors into consideration can help you identify promising investment opportunities and understand the potential risks associated with different property types.

Building a Diversified Real Estate Portfolio

Diversification is a critical aspect of real estate portfolio management that can minimize your overall risk, ensuring you have a well-balanced and resilient investment plan. A diversified investment portfolio can consist of different property types, such as single-family homes, townhouses, and apartment buildings, along with geographical diversification, which entails owning properties across various regions or neighborhoods.

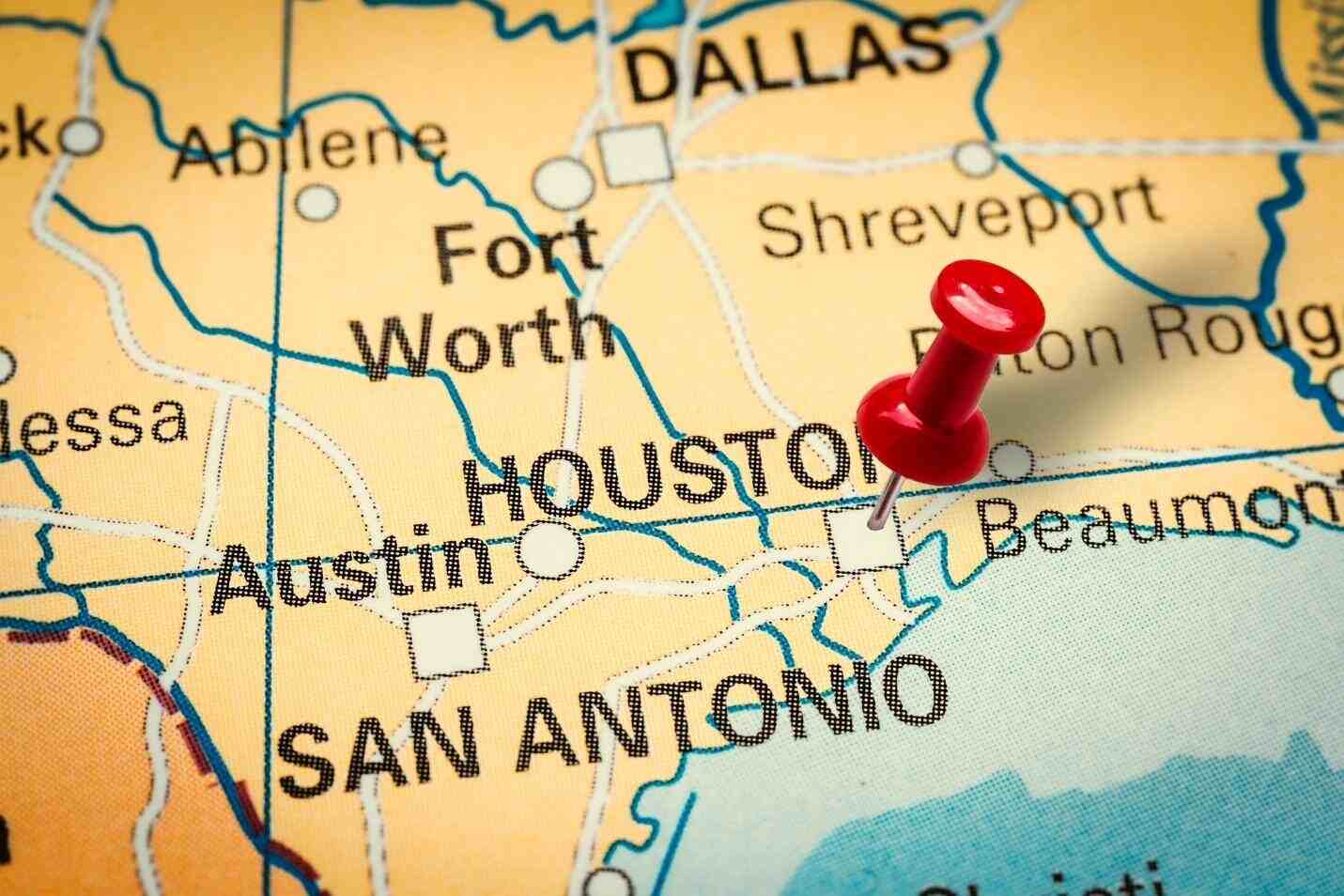

Additionally, investing across various price points, cater to different customer segments, further enhancing your portfolio’s diversification. Geographical diversification is particularly crucial in Texas, where various cities and regions can offer unique opportunities for growth. For instance, investing in major urban centers such as Austin, Houston, or Dallas can ensure strong tenant demand and rental income, whereas other regions may offer more affordable entry points and potential for long-term property appreciation.

Monitoring and Assessing Your Real Estate Investments

A crucial aspect of effective real estate portfolio management is keeping a close eye on your investments and regularly assessing them. By regularly monitoring and evaluating your properties, you can identify and address potential issues early on and make well-informed adjustments as needed. This includes:

- Tracking property performance: Domestic and foreign accredited investors should monitor rental income, vacancy rates, and appreciation trends to keep a pulse on how well their properties are performing. Regular analysis helps determine if current strategies are effective or if adjustments are necessary to improve performance.

- Assessing market conditions: Stay up-to-date on local market trends and economic indicators to identify potential shifts that could impact your investments. This insight could inform your decisions to sell, hold, or purchase additional properties.

- Property maintenance and improvement: Regularly assess the condition of your properties and schedule necessary repairs and updates. Well-maintained properties attract and retain higher-quality tenants, ensuring a steady income stream.

Best Places to Invest in Real Estate in Texas

There are numerous areas in Texas that are well-worth the investment. Here are some places investors can consider:

- Austin: Known for its vibrant cultural scene and rapid economic growth, Austin is a hotspot for real estate investments. Its thriving tech industry continues to draw people, leading to a booming housing market.

- Dallas: Dallas offers a powerful economy and strong job market, making it attractive for real estate investors. The metro area, including cities like Plano, Irving, and Arlington, also provides ample opportunities for both residential and commercial properties.

- Houston: As the largest city in Texas, Houston has a solid economy based heavily on the energy, aeronautics, and tech industries. Its vast metropolitan area presents numerous opportunities for residential, commercial, and industrial real estate investments.

- San Antonio: The city is experiencing significant growth in sectors like healthcare, finance, and IT, which is amplifying housing demand. Offering affordable housing options, it is a great place for buy-and-hold investment strategies.

Working with Real Estate Professionals

Successful real estate portfolio management often depends on the advice and expertise of industry professionals. Partnering with experienced real estate professionals can save domestic and foreign accredited investors a significant amount of time and resources spent navigating the complex and often unpredictable landscape of the Texas market. In addition, real estate professionals can provide invaluable advice on:

- Market analysis: Professional insights on property trends, median home prices, and growth rates can help you target high-potential neighborhoods and regions in Texas.

- Property acquisition: Expertise in identifying profitable properties, negotiating favorable purchase terms, and expediting the closing process can give you a competitive edge.

- Property management: A professional property manager can handle day-to-day tasks such as screening tenants, collecting rent, and overseeing maintenance, allowing you to focus on growing your portfolio.

Understanding the Basics of Real Estate Portfolio Management in Texas

In the end, remember that every investment journey is unique. What worked for one person might not necessarily work for another. So, it’s essential to establish your investment goals, understand your risk tolerance, and continually educate yourself on the changing dynamics of the Texas real estate market. With these in place and a healthy dose of perseverance, the path to successful real estate portfolio management in Texas becomes significantly smoother.

Remember, Elysium Real Estate Investments LLC can help you manage your real estate portfolio in Texas, providing access to the professional resources and expertise needed to navigate the ever-changing Texas residential real estate landscape.

Disclaimer

The Essentials of Building a Profitable Real Estate Portfolio in Texas is for educational and informational purposes only. Elysium Real Estate Investments is not responsible for errors, exclusions, or consequences from utilizing this information. This post does not offer legal, financial, investment, or professional advice. The real estate market is volatile and swingy. Real estate investing rules vary by location and might change. Before making any financial decisions, consult a competent professional or legal advisor familiar with your situation.

Real estate investment is risky and might end in a loss. Elysium Real Estate Investments cannot guarantee results or profits. Independent research and due diligence are required for investment selections. Author(s)’ thoughts may not reflect Elysium Real Estate Investments’ or its affiliates’ or staff’s official position. Any real estate properties mentioned are for illustration only and should not be taken as an endorsement or solicitation to buy, sell, or hold them. You indemnify Elysium Real Estate Investments, its affiliates, and contributors from any claim or dispute arising from your use of this material.

LEARN TO INVEST WITH US.

We accept queries from accredited domestic and foreign investors seeking single and small multifamily investment opportunities.